How to use Money Envelopes in a Modern Context + Free Templates

Hey Friends

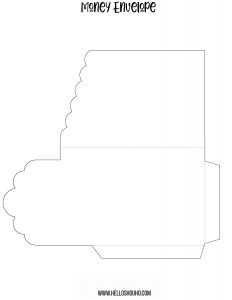

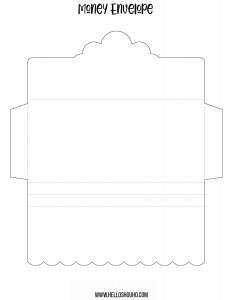

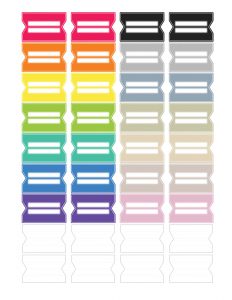

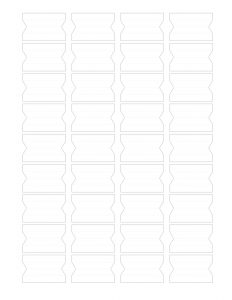

I have a couple of new downloads I am adding to the library, one is a set of money envelope patterns I created and the other are some simple tabs for planners. The envelopes I have are two styles – a top load and standard side envelope – and I wanted to give a quick overview of what Money Envelopes are and how they can be used.

So the original money envelope system is by Dave Ramsey, the basics are to use cash instead of your credit card/debit card so you can see exactly how much money you have left in each category. Those categories are up to you – but some basic ones are groceries, gas, entertainment, fast food, etc

I love the concept, and as a kid, I was able to do this easier – which is a great way to teach kids how money works. I am a huge proponent of teaching kids/teens how bills work, banks, etc. I would say it’s a fine line, however, as a kid I always thought we were poor but as an adult, I can look back and see it was a little stressed that way, but really we were fine most of the time. This made me a little anxious, which is why I mention it. No one wants a 10 year worrying about gas money. Not a current parent, but something that stressed me out as a kid (and later an adult when I didn’t know how it worked).

I also washed my money as a kid cause I was told it was dirty, so I am pretty sure the anxiety is on me; biologically.

Anyway, what I like about the envelope system is you can really SEE money. I think it needs an update though. Most things cannot be paid for with cash. I have harassed my bank – USAA – to add a section called folders to their debit accounts for this reason. Make a rent, etc folder then you can see when it gets filled. It’s much easier to keep money in a bank anyway. I am fortunate that they do allow you to make multiple savings accounts, and name them. So when I am saving for something big, i.e. a vacation – I rename that account. It helps, but not entirely what I want overall.

I also think you should stash savings in a high yielding savings account, Nerdwallet says Ally is still one highest as of June 2020 at 1.5% – Marcus is the highest but Ally is very accessible and online. So having cash at home isn’t always the best option. I get the envelopes though, and if you need a financial reset, I think this is a great start.

This is where I am. I need a financial reset. I was great in August 2019 – got laid off in NOV and we’ve been hanging on with a patient landlord and side work. So now that we are starting to get back to the start line – I decided this was a good time to start over. I probably won’t reach 0 again until the end of 2020, assuming everything keeps going good but I am looking forward to it.

So I made some envelopes. I had to ditch my credit cards, which breaks my heart as I love Capital One. They have been amazing to me. I hope to return the favor before the end of the year and just reset with them in a year.

I am sharing this with some tips on how to save money, as we are pretty frugal (I’m told).

For the envelope, I am really happy with how they turned out, and plan to offer up a few on Etsy when I get there, with decorated paper. I am using the envelopes for some long term savings – also known as sinking funds. Such as Christmas and Laundry money. These are things I would rather have saved out ahead of time than the month of. Another item I am keeping stashed is car work. I know I need tires and I just pumped $800 into it for annual mileage work, so yeah…I know those are coming so I can start putting cash in an envelope for it.

Some ideas for sinking funds

- Beauty – nails, hair, etc

- Car INS – If done annually this is a great

- Car Maintenance – good to just pile some in

- Car Tags – you know it’s due

- Christmas – expectations

- Clothes – as needed

- Entertainment – movies, eating out, etc

- Medical – just in case

- Tolls – if you have these

- Taxes – another you know it’s coming

- Vacation – great for fun spending

- Family Planning – Birth control, unexpected things, etc

- Baby / Kids – if you know it’s coming or have a friend with one on the way

There are so many more you can think of but I hope this helps explain the money envelope system – why and how to give it an update – and how to use it to be prepared throughout the year.

I made mine with scrapbooking paper

My budget is pretty bare, fortunately. Rent, Car, INS, Food, Debt. I keep everything in an excel sheet so I can see where my money is going and click it off as I pay for it. It really makes me happy to see the numbers. I also keep track of our grocery consumption week over week – and gas. I do this mostly because I like numbers but years ago we would spend something like $150+ per trip and eventually we decided this was just too much and worked to cut back on extras.

We were able to accomplish this by doing pickup instead of going in. It really helped and we are able to do about $100 per week on food, and occasionally we spend on household items an extra $50. I try to buy those things in bulk and from Target (Redcard!) but we do what we need. We live in CO and are fortunate that we can see our grocery costs online at the website(s). It’s really handy for tracking. You can really see if you went twice that week for snacks, or whatever. We are frugal by nature so that has helped us.

I hope some of these tips were new to you and if you need a money envelope pattern, you now have a great one!

These are super easy to make at home, even more so if you have a cutting machine, and are handy for planning for the future.